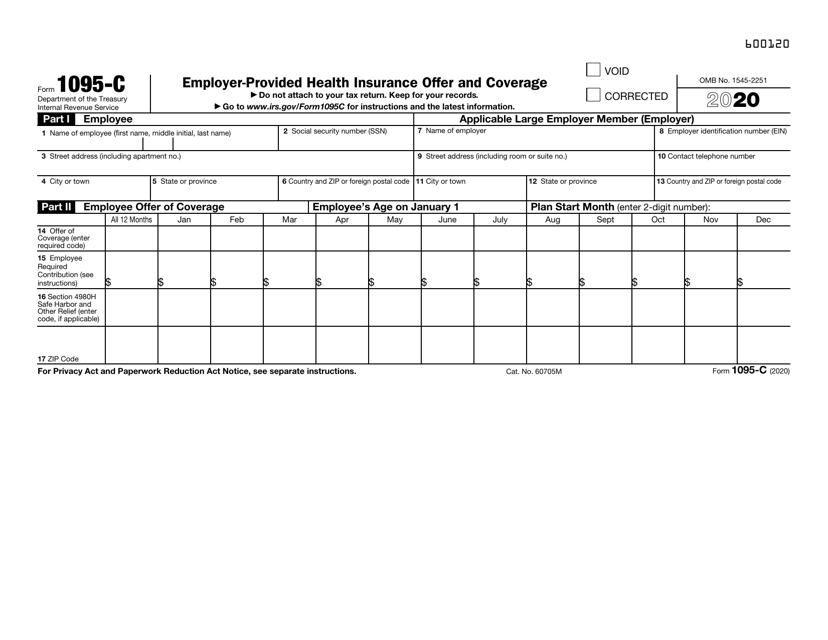

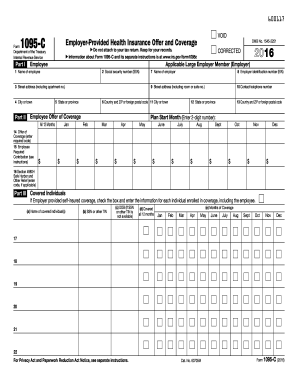

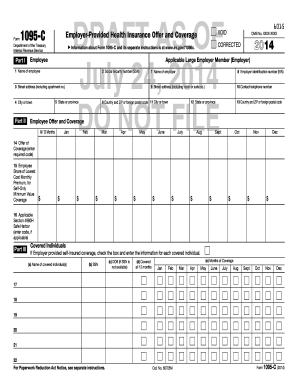

Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will then review the codes used and determine whether you are compliant with your employer mandate ACA requirements ACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095C62 Review and update Form 1094C before mailing or efiling forms to IRS Note IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page;Nov 12, · Form 1095C must be provided to the employee and any individual receiving MEC through an employer by January 31 of the year following the calendar year to which the return relates Extensions – No penalty will be imposed for federal Forms 1094C and 1095C

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

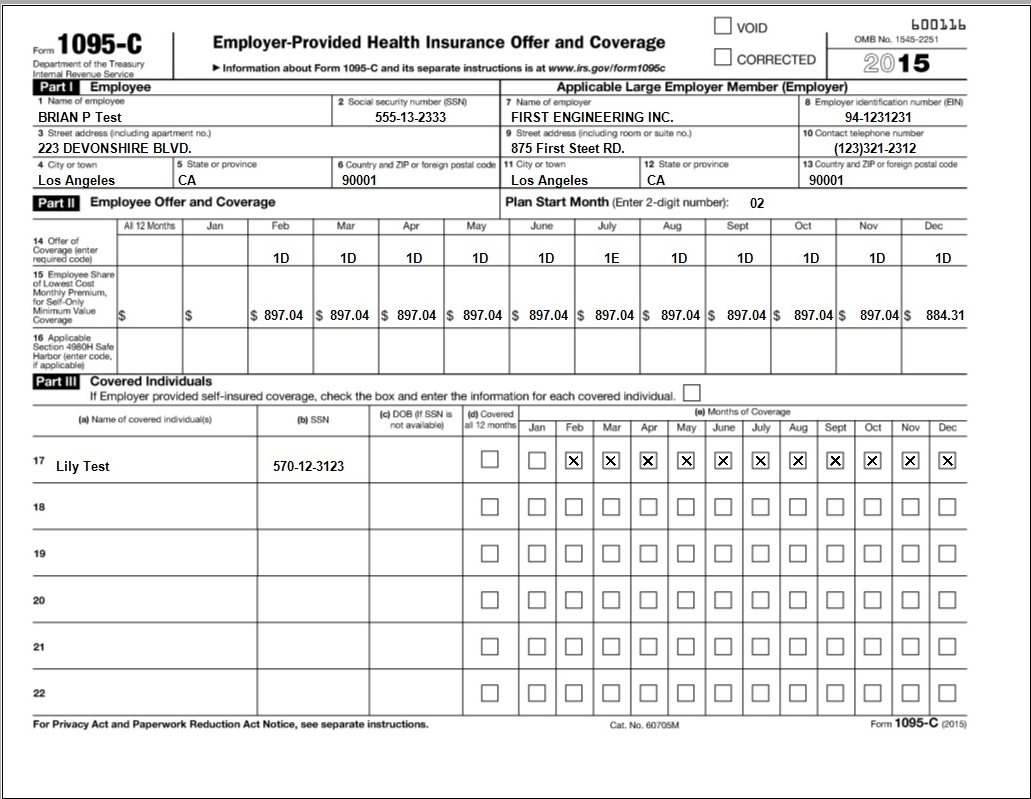

Sample 1095 c form filled out

Sample 1095 c form filled out-Sep 30, 18 · In March, you will receive your 1095C form The form can also be used to complete a person's tax return He recalled that an FTA member should only be interested 1 type of health form is a health tax Next calendar year, you may need to complete both your personal tax return 1095c information to prepare the tax returnFeb 07, 19 · This job aide provides stepbystep instructions for consenting to electronically receive Form 1095C in PeopleSoft Employees who consent to electronically receive the 1095C will be able to download the form through the Employee Self Service (ESS) Portal in PeopleSoft

Irs Form 1095 C Fauquier County Va

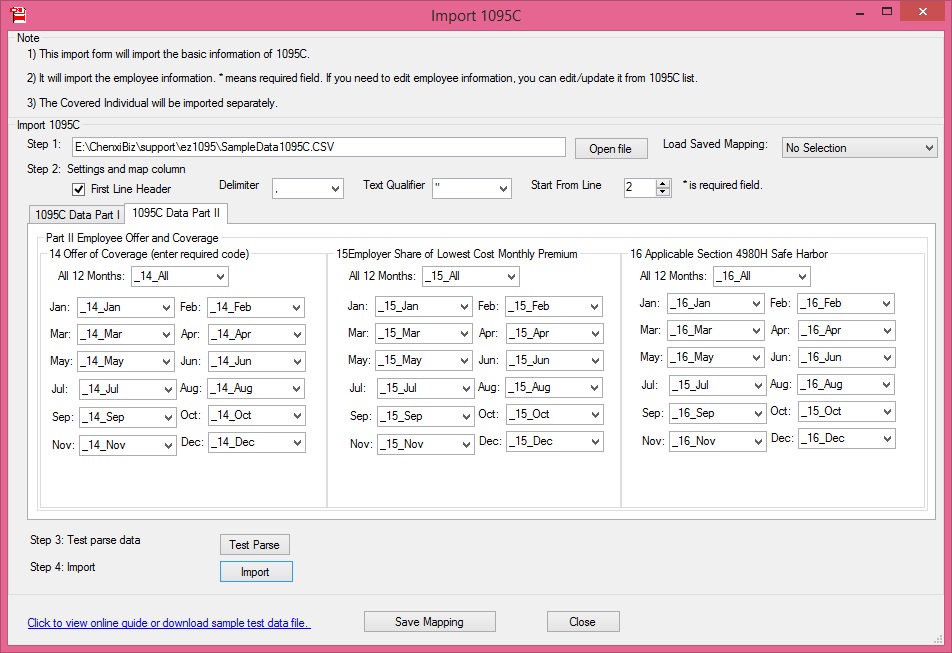

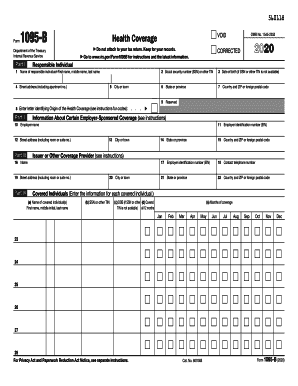

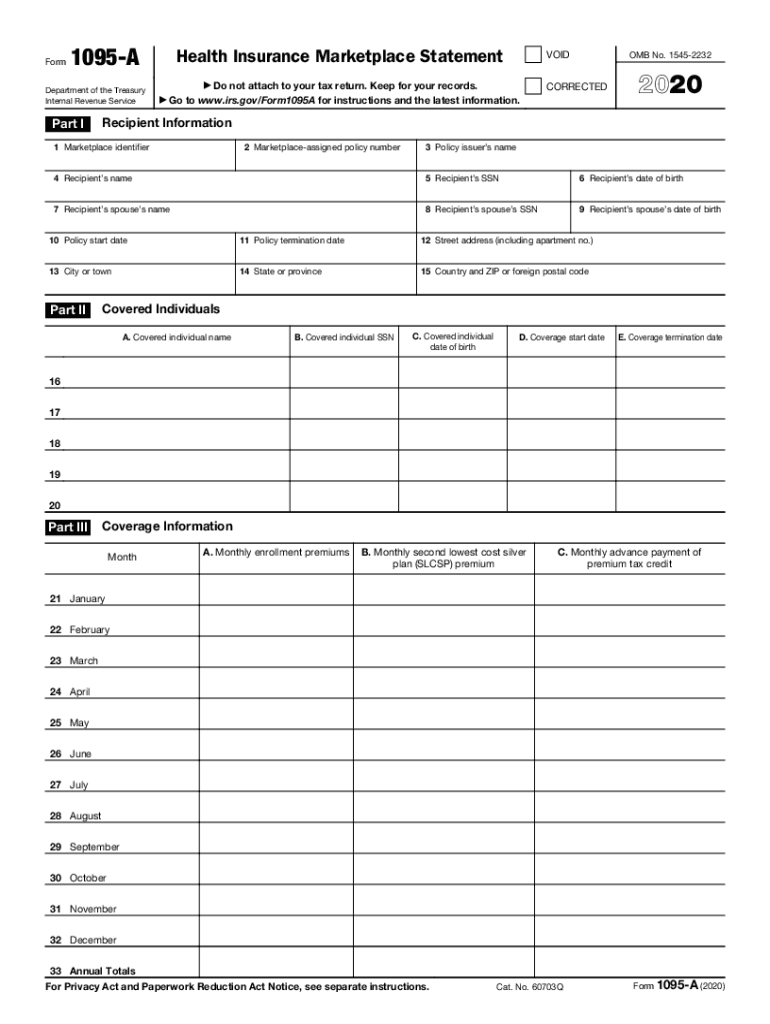

The forms are very similar The main difference is who sends the form to you The entity that provides you with health insurance will be responsible for sending a Form 1095How to complete Form 1095C In order to stay compliant with the Affordable Care Act in 16, companies with a fulltime staff of 50 or more will need to file a Form 1095C for each employee We'll help you figure out how it worksApr 27, 21 · Sample Excel Import File 1095C xlsx IRS 1095C Form 1095C Form IRS 1095C Instructions

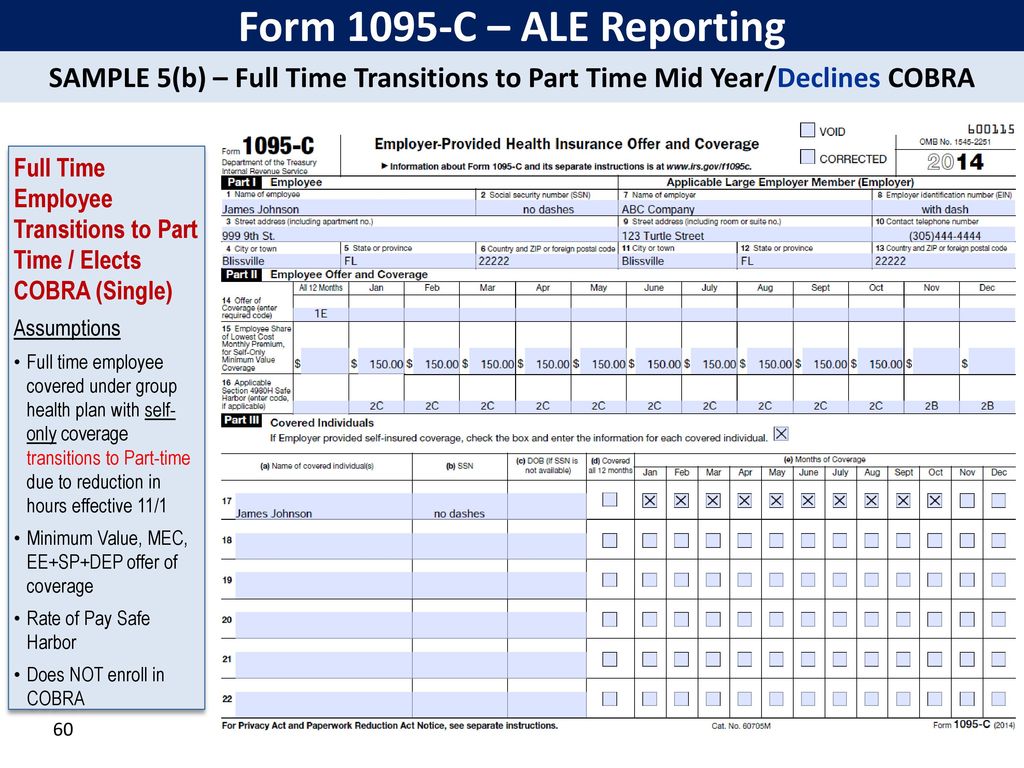

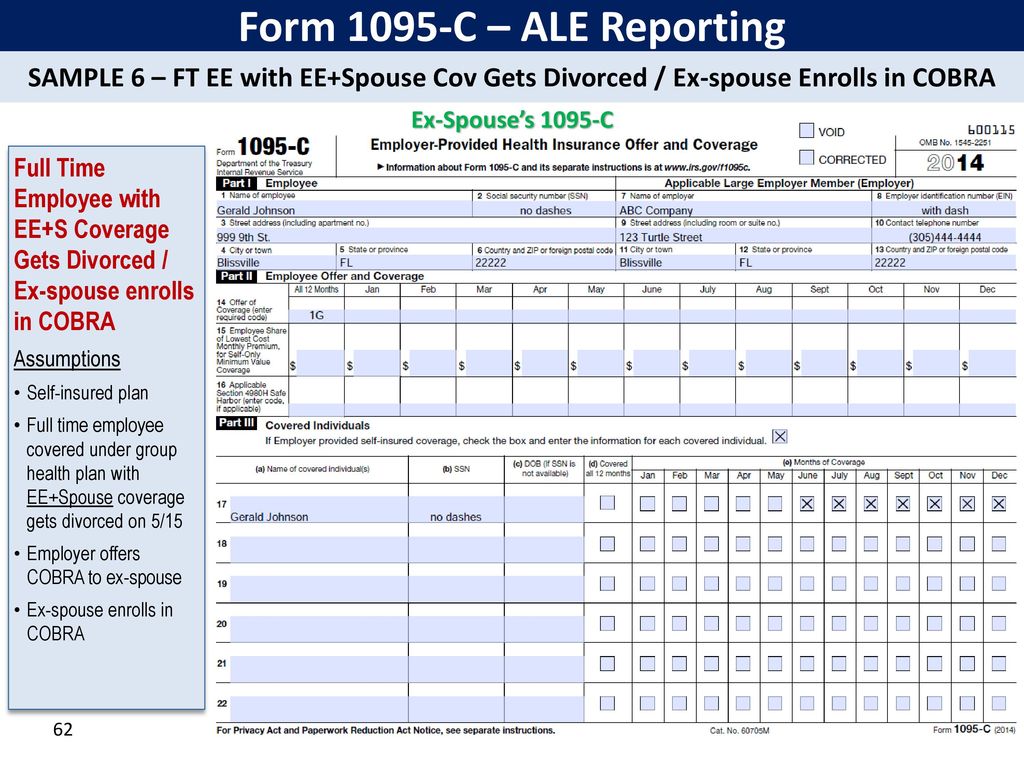

Oct 03, 18 · Self‐insured employers must report offers of COBRA coverage Employers complete Form 1095‐C providing COBRA coverage information (enrollment in COBRA coverage) How the Form 1095‐C is completed will depend, in part, on whether the employee was covered as an active employee during 18If you are using a 1095C Import Template spreadsheet, select Sample 1095C from the Template dropdown list, click Next, and then skip to step 5 If the spreadsheet includes column headings or other rows of data that should not be imported, mark the checkbox in the Omit row column for that rowForm 1095A, B or C with your individual federal income tax return to prove compliance with the individual mandate Q4 When should I receive a Form 1095C?

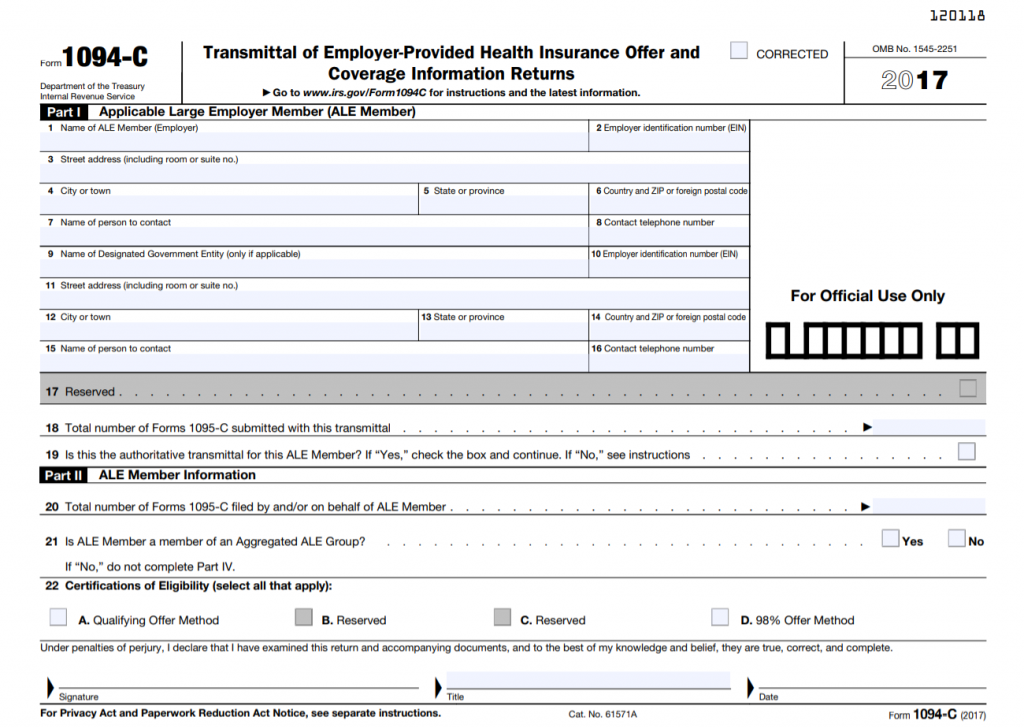

John Barlament walks through how to fill out IRS forms 1094C and 1095C This presentation was given to selffunded employers at an Alliance Learning CircleIRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a cover sheet about the 1095CAccording to the IRS, you have to file 1095 C sample if you have obtained health insurance from any of the exchanges provided by healthcare or any of the state exchanges The exchanges are also known as the Affordable Care Act Where to file 1095 C?

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Form 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn moreWhen to file Form 1095 C?Form 1095C EmployerProvided Health Insurance Offer and Coverage is an Internal Revenue Service (IRS) tax form reporting information about an employee's health coverage offered by

Free 1095 C Resource Employee Faqs Yarber Creative

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

What is Form 1095C?Jan 23, 19 · Is form 1095C required when filing taxes?Form 1095C is intended to include all the necessary information to allow the recipient and/or the tax preparer to properly complete and file the recipient's tax return All applicable large group employers (ALE's) are required to prepare, distribute and file IRS Form 1095C This form includes information that will

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Ez1095 Software Speeds Up 1095 C Filing With Quick Data Uploading Feature Newswire

Form 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee2 3 On the Self Service page, select the Benefits option on the left side, second row 4 On the Benefits page, select 1095C Consent 5 Read the language below regarding consent to electronically receive the 1095C If you agree, select the checkbox in front of "I consent to electronically receive Form 1095C" and select SubmitFeb 17, 16 · Information included in the Form 1095C (including an explanation of Part III for selfinsured plans) Descriptions of why an employee may receive multiple Forms 1095C As a special bonus, we have also included a sample employee letter for use by small selfinsuring employers —generally those with fewer than 50 fulltime employees (including

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

1095c Departmant of Træsl_ry Internal RevenlÆ Service Part I Employee 1 Name of employ— Employee Smith 3 Stræt address apartment ro) 123 Maple Drive Unit 2 EmployerProvided Health Insurance Offer and Coverage Do not attach to your tax retum Keep for your records Information about Form 1095C and its separate instructions is at CORRECTEDKB Sample EMail The following email is an example only and uses the disclosure requirements set forth in IRS Publication 15a and Treasury Regulations Sub Chapter C Sec (j) Email Subject IMPORTANT TAX RETURN DOCUMENT AVAILABLE Email Body Fabrikam is pleased to offer 1095C statements via email this year instead of the traditional paper copy!Sample Output 1094B/1095B and 1094C/1095C Upload Specifications Files must be created using a piped delimited text (txt) file format XML, Zip or compressed files will NOT be accepted Files 250MB or larger must be submitted as multiple submissions Files that are 250MB or

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Accurate 1095 C Forms Reporting A Primer Integrity Data

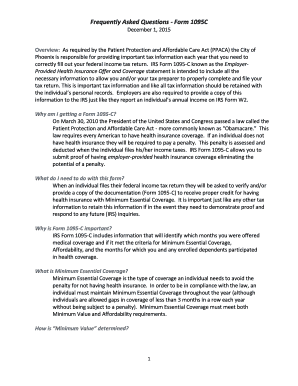

View Our Sample Form 1095C What is the difference between a 1095A, 1095B, and 1095C?You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, PartYou have probably heard of Health Care Reform and the Affordable Care Act (ACA), and one requirement that may impact you directly is Form 1095C Organizations that employ more than 50 people are required to report to the IRS on the health insurance, if any, offered to their fulltime employees

Common 1095 C Coverage Scenarios With Examples Boomtax

Your 1095 C Tax Form My Com

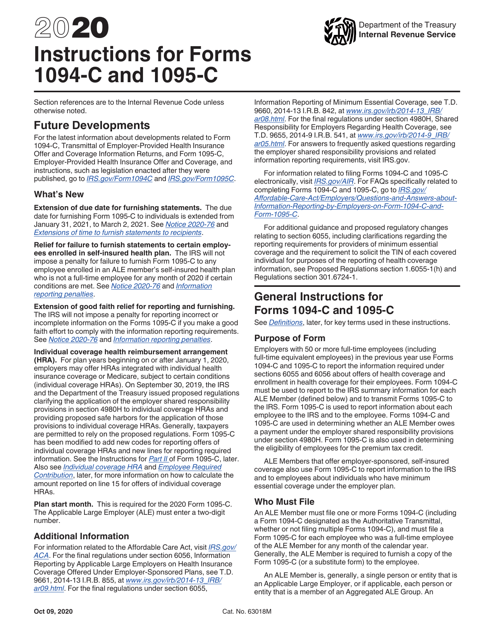

Sample 1095 C formForm 1095C for each employee who was a fulltime employee of the ALE Member for any month of the calendar year Generally, the ALE Member is required to furnish a copy of the Form 1095C (or a substitute form) to the employee An ALE Member is, generally, a single person or entity that isDec 30, 15 · Form 1095C may be sent electronically like the W2 if the IRS electronic distribution requirements are met, but the employer must receive consent from the employee separate from the W2 All of the 1095C forms must be submitted with the 1094C If you are filing over 250 1095C forms, you are required to file electronically February 28th, 16

1095 C Sample Hcm 401 K Human Resources

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Form 1095C is used by applicable large employers (as defined in section 4980H(c)(2)) to verify employersponsored health coverage and to Form1095C Colorado State University Colorado State University provides employees with the 1095C tax formJan 18, 15 · The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage,A Employers are required to distribute Forms 1095C by March 31, 16 The form provides information relating to

.png)

What Payroll Information Prints On Form 1095 C To Employees

Sample Print Of 1095 B And 1095 C 1095 Software

Form 1095C is sent to certain employees of applicable large employers Applicable large employers are those with 50 or more fulltime employees Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage1095C Form The Affordable Care Act of 10 requires most individuals to maintain and provide proof of health care coverage To support this requirement, the law also requires employers to issue form 1095B, 1095C, or both (depending on their employment and coverage status) to allB1 Understanding the Sources for Forms 1095C and 1094C and1095C XML The Form 1095C print and the 1094C or 1095C XML files are handled through the JD Edwards Electronic Document Delivery (EDD) system The system uses the data item aliases during the spool file batch export step to create XML source files, which are then used to map the information to

1095 C Software 1095 C Software To Create Print And E File Irs Form 1095 C

Sample 1095 C Forms Aca Track Support

Jan 18, 16 · Recently, the IRS extended the deadline for distributing IRS Forms 1095C and 1095B to employees from February 1, 16 to March 31, 16 As such, Kistler Tiffany Benefits is providing its clients with customizable letters that may be issued to employees explaining the new employee returns (either the Form 1095B or Form 1095C) These letters could be included inSample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19When information on Part II of a 1095C is conflicting with Part III, selfinsured employers are perplexed about their Affordable Care Act reporting

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Benefits 1095 C

Form 1095C is a new form designed by the IRS to collect information about applicable large employers and the group health coverage, if any, they offer to their fulltime employees Employers will provide Form 1095C (employee statement) to employees and file copies, along with Form 1094C (transmittal form), to the IRS Form 1095C isFeb 08, 19 · IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax seasonWithin a submission every Form 1095C requires a RecordId RecordId should start at 1 and increment by 1 sequentially for each Form 1095C in the submission

Aca Reporting Penalties Abd Insurance Financial Services

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

The good news for employees is that, like last year, the IRS will not require tax payers to submit a copy of form 1095C when they file their taxes Tax preparers may request a copy of the form, but it is not required to fileLet's Look At The Most Common 1095C Coverage ScenariosForm 1095C is a new IRS tax form that you received because your employer is subject to the employer shared responsibility provision in the Affordable Care Act A sample form

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Form 1095C contains information about the offer of health insurance coverage to employees and their dependents, the employee's share of the lowestcost premium, and other information related to employer responsibility provisions Information on this form is required to prepare and file your annual tax returnForm 1095C is used to report information about each employee to the IRS and to the employee Forms 1094C and 1095C are used in determining whether an ALE Member owes a payment under the employer shared responsibility provisions under section 4980H Form 1095C is also used in determining the eligibility of employees for the premium tax creditYou need to file a form at the service

Filing Aca Form 1095 C Is Easy With Ez1095 Software For School Administrators Newswire

Ez1095 Software How To Correct 1095 C And 1094 C Form

Apr 19, 16 · The 1094C is your title page, and the 1095C is the actual report itself And in this case, the report contains vital details about each employee's health insurance for the year Together, these forms are used to determine whether youEmployers are required to furnish Form 1095C only to the employee As the recipient of this Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their recordsFeb 24, · When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14

Ez1095 Software How To Print Form 1095 C And 1094 C

Aca Reporting Tip 16 Line 16 Union Employees Usi Insurance Services

Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was covered This form is sent out by theClick the top menu "Current Company" then the sub menu "Form 1094C" to view 1094C screen Note ez1095 software can print both 1095C and 1094 C forms for IRS and recipients on white paper No preprinted form is needed IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page;

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

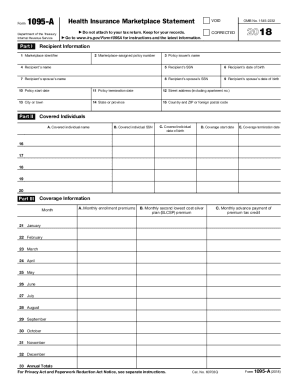

Form 62 Premium Tax Credit Definition

1094 B 1095 B Software 599 1095 B Software

Aca

Form 1095 C The Aca Times

Irs Form 1095 C Fauquier County Va

Sample 1095 C Forms Aca Track Support

1094 C 1095 C Software 599 1095 C Software

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)

About Form 1095 A Health Insurance Marketplace Statement Definition

Control Tables And Sample Forms

Irs 1094 C Form Pdffiller

Common 1095 C Coverage Scenarios With Examples Boomtax

Control Files And Sample Forms

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

1094 B 1095 B Software 599 1095 B Software

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Annual Health Care Coverage Statements

trix Irs Forms 1095 B

Form 1095 A 1095 B 1095 C And Instructions

F O R M 1 0 9 5 C E X A M P L E S Zonealarm Results

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Questions Employees Might Ask About 1095 C Forms Bernieportal

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Sample 1095 C Forms Aca Track Support

Sample 1095 C Forms Aca Track Support

Sample Print Of 1095 B And 1095 C 1095 Software

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 C Guide For Employees Contact Us

Updated Sample Employee Letters For Irs Forms 1095 B And 1095 C Kistler Tiffany Benefits

What Payroll Information Prints On Form 1095 C To Employees

Think 14 Tax Forms Are Bad Here Come The 1094 And 1095 For 15 Clemons Company Clemons Company

Sample 1095 C Forms Aca Track Support

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Sample Of 1095 C

Ez1095 Software How To Print Form 1095 C And 1094 C

Common 1095 C Coverage Scenarios With Examples Boomtax

1094 C 1095 C Software 599 1095 C Software

1095 C Form Printable Fill Online Printable Fillable Blank Pdffiller

Form 1095 A 1095 B 1095 C And Instructions

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Fillable Online Employee Phoenix Sample 1095 C Form Employee Phoenix Fax Email Print Pdffiller

Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

1095 A Form Fill Out And Sign Printable Pdf Template Signnow

1095 C Eemployers Solutions Inc

Aca Code Cheatsheet

1095 C Print Mail s

Accurate 1095 C Forms Reporting A Primer Integrity Data

Ez1095 Software How To Print Form 1095 C And 1094 C

Sample 1095 C Forms Aca Track Support

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

1095 C Form Official Irs Version Discount Tax Forms

1095 C Fillable Form Fill Out And Sign Printable Pdf Template Signnow

Form 1095 C Forms Human Resources Vanderbilt University

0 件のコメント:

コメントを投稿